Are you looking for the Montana Department of Revenue mailing address? You're in the right place. This guide will provide you with all the necessary information about the Montana Department of Revenue, its mailing addresses, and how to interact with the department effectively.

The Montana Department of Revenue plays a crucial role in managing state finances, tax collection, and revenue-related services. Whether you're filing your taxes, registering a business, or seeking assistance with tax-related issues, knowing the correct mailing address is essential.

Throughout this article, we'll explore the Montana Department of Revenue's mailing address, its various services, and how you can make the most out of your interactions with the department. Let's dive in!

Read also:How To Contact Channel 9 News A Comprehensive Guide

Table of Contents

- Introduction

- Montana Department of Revenue Overview

- Montana Department of Revenue Mailing Address

- Services Provided by the Department

- Tax Filing and Payment

- Business Registration and Licensing

- Property Tax and Assessment

- Frequently Asked Questions

- Tips for Effective Communication

- Sources and References

- Conclusion

Montana Department of Revenue Overview

History and Mission

The Montana Department of Revenue (MDR) was established to manage and administer the state's revenue system. Its mission is to ensure fair and equitable tax collection, provide excellent customer service, and support the economic growth of Montana.

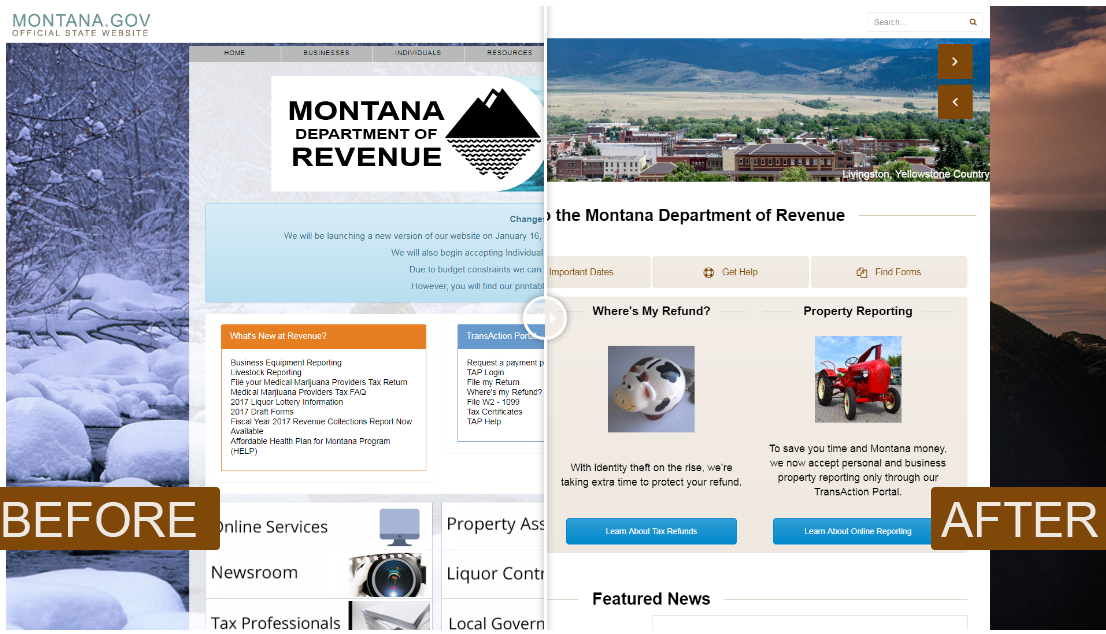

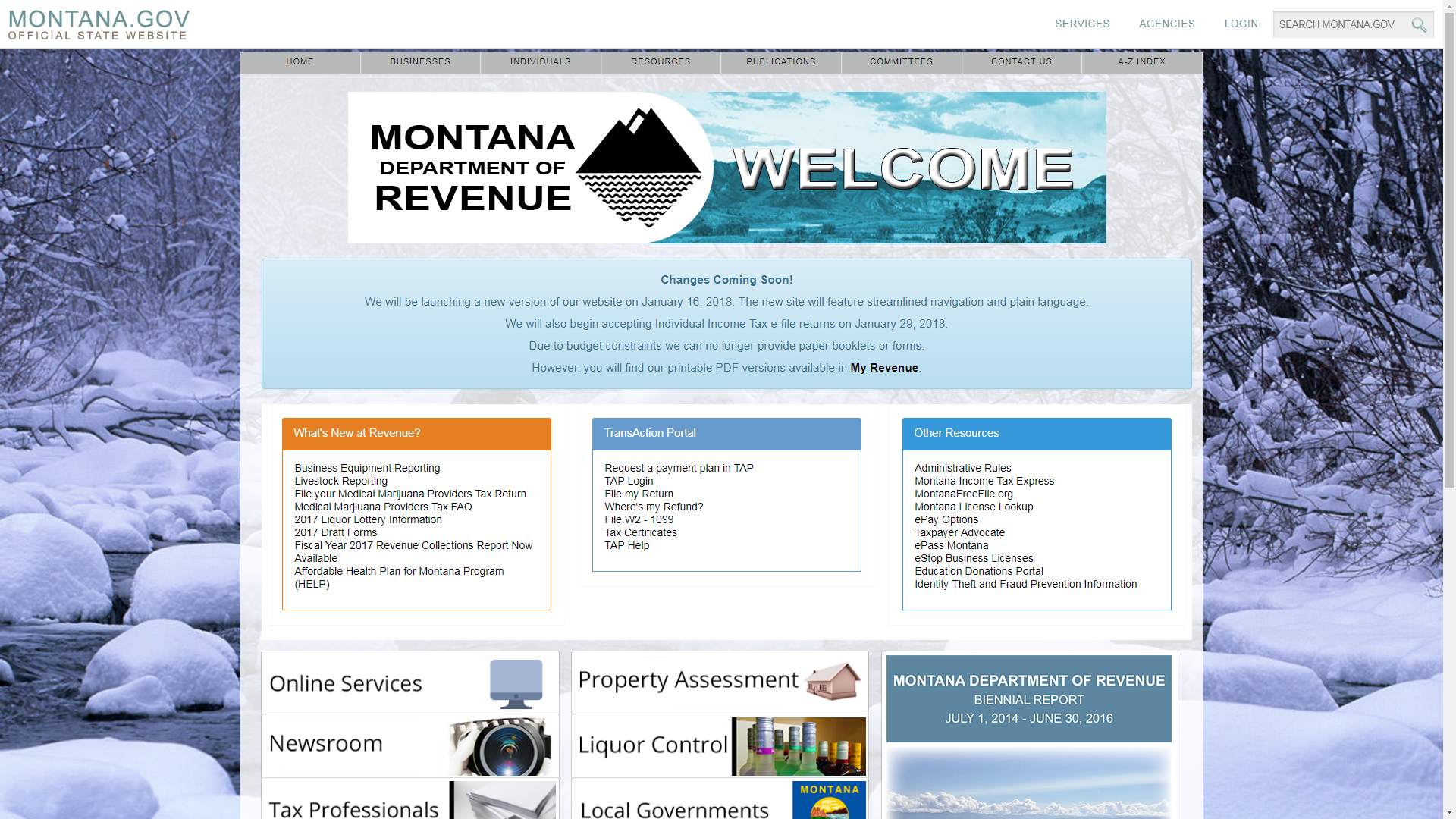

Since its inception, the department has evolved to meet the changing needs of the state and its residents. It continuously updates its processes and systems to enhance efficiency and transparency.

Montana Department of Revenue Mailing Address

For correspondence with the Montana Department of Revenue, you can use the following mailing address:

Montana Department of Revenue

P.O. Box 200500

Helena, MT 59620-0500

This address is used for general inquiries, tax filings, and other revenue-related submissions. Ensure that all documents are clearly labeled and include your contact information for prompt processing.

Services Provided by the Department

Tax Administration

The Montana Department of Revenue handles various tax-related services, including:

Read also:Dua Lipa Concert Dates Your Ultimate Guide To The Global Tour

- Income tax filing

- Sales and use tax

- Excise tax

- Fuel tax

License and Registration

In addition to tax services, the MDR also oversees:

- Business license registration

- Vehicle registration

- Professional licensing

Tax Filing and Payment

Filing your taxes accurately and on time is crucial for compliance with state regulations. The Montana Department of Revenue provides multiple options for tax filing, including online submissions and traditional mail.

When mailing your tax forms, ensure that you use the correct Montana Department of Revenue mailing address to avoid delays or misplacement of your documents.

Business Registration and Licensing

Registering a Business

Starting a business in Montana requires proper registration with the Department of Revenue. The process involves:

- Filling out the necessary forms

- Submitting required documents

- Payment of applicable fees

Business owners can mail their registration forms to the Montana Department of Revenue mailing address provided earlier.

Licensing Requirements

Depending on the nature of your business, you may need additional licenses or permits. The MDR offers guidance and assistance in obtaining these credentials.

Property Tax and Assessment

Property tax is a significant source of revenue for Montana. The Department of Revenue works closely with local governments to ensure accurate property assessments and fair taxation.

Property owners can appeal their assessments if they believe the valuation is incorrect. Appeals should be submitted in writing to the designated Montana Department of Revenue mailing address.

Frequently Asked Questions

What is the Montana Department of Revenue?

The Montana Department of Revenue is a state agency responsible for managing revenue collection, tax administration, and related services.

Can I file my taxes online?

Yes, the MDR offers online filing options through its official website. However, if you prefer mailing your forms, use the Montana Department of Revenue mailing address.

How long does it take to process my tax return?

The processing time varies depending on the complexity of your return and the method of submission. Mailed forms may take longer than online filings.

Tips for Effective Communication

When interacting with the Montana Department of Revenue, consider the following tips:

- Always use the official Montana Department of Revenue mailing address.

- Keep copies of all submitted documents for your records.

- Respond promptly to any correspondence from the department.

- Utilize online resources and tools for faster service.

Sources and References

This article draws information from the official Montana Department of Revenue website and other reputable sources. For more detailed information, visit:

Conclusion

In summary, the Montana Department of Revenue mailing address is a critical piece of information for anyone dealing with state taxes, business registration, or property assessments. By understanding the department's services and utilizing the correct mailing address, you can ensure smooth and efficient transactions.

We encourage you to share this article with others who may benefit from the information. If you have any questions or feedback, feel free to leave a comment below. Thank you for reading, and don't hesitate to explore our other resources for more insights on financial and administrative matters.